20 Jan, 2025 | Admin | No Comments

Inside MicroStrategy’s Bitcoin Holdings Over the Years: 447,470 BTC and Counting!

The post Inside MicroStrategy’s Bitcoin Holdings Over the Years: 447,470 BTC and Counting! appeared first on Coinpedia Fintech News

The report discusses microstrategy

Business Intelligence

strategies for acquiring Bitcoins since 2019, its history of purchases, funding methods, stock performance, measures taken for custodianship, and whether it is really challenged by big regulatory hurdles.

Key Findings:

- Total Bitcoins: 447,470 as of January 2025

- Total Investment: $27.97 billion.

- Market Value: $16.5 billion (at $36,900 per BTC).

- Cost per Bitcoin averaged: $ 62,503

- Market value today: Approximately $ 16.5 billion on a trading value of $36,900 per Bitcoin.

- Stock Performance: MicroStrategy’s stock price has shown extraordinary growth since the company adopted a Bitcoin-focused strategy in August 2020. Over the past 4.5 years, the share price has increased by 1,600%, far outperforming the S&P 500 technology index.

- Unique Positioning: Bitcoin is the biggest corporate holder in the world, beating its peers like Tesla and Square.

The Evolution of MicroStrategy

Founded by michael saylor

michael saylor

Michael J. Saylor is an enthusiastic blockchain influencer and a splendid leader. He is an entrepreneur and business executive who co-founded Microstrategy, he is chairman and CEO of the same Microstrategy. He is a vocal advocate of Bitcoin. He is highly skilled in enterprise software and also has a rich knowledge of numerous fields, including analytics, data warehouses, leadership, SaaS, management, cloud computing, startups, professional services, enterprise architecture, mobile devices, and many more.

Location: United States

Education :

He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society.

Experience:

He has been an Executive Chairman & Founder at MicroStrategy from Aug 2022 – Present

He was also Chairman, CEO & Founder of MicroStrategy from Oct 1989 to Aug 2022

Skills: Buisness Intelligence and Data warehousing

Net Worth: Saylor's net worth is about $4.6 billion, according to Forbes. He also held 2.4 million shares of MicroStrategy

Events Attended: Bitcoin 2024 Nashville and BTC prague

msaylor@microstrategy.com

EntrepreneurCrypto and Blockchain ExpertAuthor

and Sanju Bansal in 1989, MicroStrategy began as a company that provided business intelligence and analytics software. The company was recognized for its innovative enterprise analytics, cloud solutions, and data insights products and services. By 2020, MicroStrategy, struggling in software sales under Saylor, made a dramatic transition into Bitcoin investment.

- Headquarters: Tysons Corner, Virginia, USA.

- Core Business: Enterprise software development and data intelligence solutions.

- Annual Revenue: $500 million (2024 estimate).

Michael Saylor

A self-proclaimed Bitcoin advocate, Michael Saylor has been a strong force behind MicroStrategy’s turn towards cryptocurrency. He, as the Executive Chairman and earlier CEO of the company, led its efforts in this direction, referring to Bitcoin as the superior asset class that could protect shareholder value during an unstable economy and inflation.

Switch to Bitcoin Treasury Strategy

Why Bitcoin?

- Inflation Hedge: Saylor said that fiat currencies risk devaluation due to aggressive monetary policies undertaken during the COVID-19 pandemic.

- Reserve Asset Innovation: Bitcoin represented a digital equivalent of gold and thus had strong potential for appreciation.

- Corporate Strategy: The goal was to make shareholder returns by investing in Bitcoins.

Timeline of Strategic Bitcoin Announcements

Key Events in Bitcoin Adoption:

1. August 2020: Initial Bitcoin Purchase

- Details: Purchased 21,454 BTC for $250 million, with an average price of $11,653 per Bitcoin.

Reasoning:

- Hedge against inflation.

- Preserve corporate treasury value.

- Anticipate Bitcoin’s long-term appreciation.

2. September 2020: Bitcoin Becomes Reserve Asset

- CEO Michael Saylor announced Bitcoin as the company’s new reserve asset, replacing traditional strategies.

Motivation:

- Growing distrust in fiat currencies due to macroeconomic uncertainty, exacerbated by the COVID-19 pandemic.

- Saylor’s personal belief in Bitcoin’s potential as a “digital gold.”

3. December 2020: Increased Investment

- Purchased 29,646 BTC for $650 million at an average price of $21,925 per Bitcoin.

- Funded the acquisition using convertible senior notes.

4. Subsequent Acquisitions (2021-2025)

- The company continued acquiring Bitcoin using proceeds from share sales and debt issuances.

- Purchases were guided by extensive internal research and consultations with financial experts.

MicroStrategy Bitcoin Holdings

| Year | BTC Purchased | Cumulative Holdings | Total Investment (USD) | Average Purchase Price (USD) | Market Context |

| 2020 | 29,646 | 51,100 | $650 million | $21,925 | Year-end strategic investment |

| 2021 | 13,005 | 83,557 | $489 million | $37,617 | Mid-year investment expansion |

| 2022 | 24,000 | 107,557 | $1.4 billion | $52,093 | Leveraging market opportunities |

| 2023 | 16,796 | 136,686 | $825 million | $68,324 | Continued aggressive acquisition |

| 2024 | 52,000 | 225,686 | $4.6 billion | $88,461 | Record quarterly purchase |

| 2025 | 1,070 | 447,470 | $101 million | $94,392 | Continued strategic accumulation |

Public Disclosures & Transparency

Disclosure mechanisms set forth by MicroStrategy cover the company’s Bitcoin acquisition and holding strategy entirely and transparently:

Quarterly Earnings calls

Earnings call transcripts feature detailed discussions through which stakeholders find updates on acquiring Bitcoins, raising funds, as well as associated impacts on overall financial performance. The calls may also indicate what Bitcoin investments intend to do as part of company-wide goals and objectives.

SEC Filings

- 8-Ks and 10-Qs make SEC filings under which there have been disclosures

- Number of Bitcoin acquired.

- Total acquisition cost.

- Accounting accounting provisions for holding (f. Ex. impairment costs U.S. GAAP).

- Risks of Bitcoin investments.

Press Releases and social media

Major bitcoin acquisitions are done through press releases and widely shared on social media platforms. MicroStrategy’s Executive Chairman, Michael Saylor, usually gives moment-by-moment updates to X, formerly Twitter.

Regulatory Considerations

MicroStrategy follows the SEC requirements for material disclosing, such as:

- Prompt reporting of significant purchases of Bitcoin.

- All-in expenses, market price, and accounting principle of financial statement.

- Impairment charges are reported transparently in the financial statement whenever the market price of Bitcoin goes below its cost.

Funding & Capital-Raising Methods

Convertible Debt Offerings

MicroStrategy has made several convertible notes to fund Bitcoin purchases. These include:

- Dec 2020: $650 million at 0.75% interest due in 2025.capital

- Feb 2021: $1.05 billion at a conversion price of $1,432.50 per share.

Equity Offerings

Stock issuances, including ATM programs, have provided additional :

- 2022: Raised $500 million.

- 2024: Will raise $2 billion in ATM offerings.

- Corporate Cash Flow Utilization

Financing Approaches

MicroStrategy has taken a balanced approach to fund its Bitcoin purchases:

1. Internal Cash Balances:

- Used $250 million of existing treasury balances in its first purchase.

- Tapped operational cash flow from its profitable enterprise software business to augment purchases.

2. Creative Financing:

- Convertible Notes: Issued convertible debt, raising billions of dollars at low interest rates, taking advantage of market conditions.

- At-the-Market (ATM) Equity Sales: Sold shares to raise additional capital for Bitcoin purchases.

- Perpetual Preferred Stock: Issued equity instruments to diversify funding sources.

Financial Breakdown

Total Investment in Bitcoin: $27.97 billion (as of 2024).

Sources of Funding:

- 40% from internal reserves.

- 35% from debt financing.

- 25% from equity offerings.

Impact on Balance Sheet

- Leverage Ratio: The debt-to-equity ratio increased significantly post-2020.

- Liquidity: Keep $800 million cash on hand to run the business.

Stock Implication for MSTR

Stock Performance

- MicroStrategy shares increased from $124 in August 2020 to $1,982 in January 2025.

- There is a direct relationship between the stock price and the price of Bitcoin.

- The share price peaked at $2,456 in November 2024.

Investor Psychology

Market Attitude

- Institutional Buyers: The institutional investors do not buy much because they prefer to invest in MicroStrategy as a long-term proxy for Bitcoin, with the name reflecting the business relationship between the two.

- Retail Investors: There is high demand from retail investors who view MicroStrategy’s stock (MSTR) as a proxy for holding Bitcoin directly.

Stock Performance:

- MSTR had a 244% return in 2024 and 1,600% over four years.

- It currently trades at a premium of 2.783 times Bitcoin-equivalent net asset value.

Risk Factors

- Impairment Losses: Accounting standards require MicroStrategy to recognize unrealized losses when the price of Bitcoin falls.

- Regulatory Scrutiny: Legal risks are still present due to the ambiguous regulatory environment of cryptocurrency.

Wallet Addresses & Custody Strategy

Security Protocols

- Primary Custodian: The firm owns its Bitcoins with Coinbase Custody, which provides institutional-grade custody and cold storage.

- Multi-Signature Wallets: These require multiple private keys to sign transactions, improving security and reducing the risk of unauthorized access.

- Geographical Dispersion of Storage: Private keys are stored in various geographically dispersed vaults to avoid single points of failure.

Risk Mitigation

- Insurance Coverage: Wider ranges of insurance cover all risks posed by theft or loss of Bitcoin.

- Security Audits: Internal audits and third-party audits are carried out regularly to ensure compliance with institutional security standards.

Security Measures

- Private keys are kept in geographical dispersion vaults.

- Insurance covers theft or loss.

- Publicly Known Wallets

- MicroStrategy keeps its wallet information private to avoid security weaknesses.

Corporate Governance

Leadership Dynamics

- Michael Saylor: Being the one to design the Bitcoin strategy at MicroStrategy, Saylor has played a big role in how the company operates. His aggressive public presence helped bolster the confidence for enthusiasts and investors.

- Board of Directors: This board has nine independent directors. It has made an open announcement supporting the Bitcoin strategy while maintaining concerns over the shareholders’ apprehension.

Shareholder Considerations

Equity offerings to support Bitcoin purchases cause shareholders to be concerned about dilution.

Shareholders continue to be concerned with the firm’s reliance on Bitcoin as the market is very volatile.

Possible Regulatory and Market Trends

Regulatory Environment

- Higher Scrutiny: The SEC has been watching public companies that own cryptocurrencies, specifically the accounting treatment and reporting of digital assets.

- New Accounting Principles: The Financial Accounting Standards Board is set to adopt changes in impairment loss, which would allow firms to include the fair market value of cryptocurrencies in their balance sheets.

Compliance Strategy

- Proactively interacting with regulatory agencies in response to any issues.

- Tailoring reporting formats to change over time based on new guidance.

- Providing ample disclosures for the sake of clarity.

Bitcoin Market Trend

According to analysts, Bitcoin will increase to $200,000 in 2025, giving MicroStrategy substantial benefits. Inflation and monetary policies will dictate Bitcoin’s path.

- Bitcoin Position: MicroStrategy will own 447,470 BTC by 2024, which is the biggest corporate treasury in Bitcoin.

- Funding Modes: The use of innovative financing modes, including convertible notes and ATM equity sales, has made it possible to maintain the acquisition strategy.

- Implication for MSTR Stock: MSTR stock tends to mirror the performance of Bitcoin in its market dynamics and thus offers the investor a singular exposure to the cryptocurrency market.

.article-inside-link {

margin-left: 0 !important;

border: 1px solid #0052CC4D;

border-left: 0;

border-right: 0;

padding: 10px 0;

text-align: left;

}

.entry ul.article-inside-link li {

font-size: 14px;

line-height: 21px;

font-weight: 600;

list-style-type: none;

margin-bottom: 0;

display: inline-block;

}

.entry ul.article-inside-link li:last-child {

display: none;

}

Future Outlook

- Continuation of Bitcoin Accumulation Strategy: The company would continue to accrete Bitcoins while using existing and novel financing modes.

- Market Impact: MicroStrategy’s aggressive move may become a template for other firms looking to embrace cryptocurrencies as their reserve assets.

Market Volatility

- Bitcoin’s price is known for significant fluctuations, with potential quarterly variations of 40-50%.

- A substantial portion of MicroStrategy’s assets is tied to Bitcoin, exposing the company to financial instability during downturns.

Regulatory Risks

- Regulatory uncertainty looms over the cryptocurrency market, with:

- Potential SEC scrutiny of corporate crypto holdings.

- Differences in regulations across countries, complicating compliance.

Strategic Vulnerabilities

- Overconcentration: With most of its treasury invested in a single volatile asset, MicroStrategy faces liquidity risks.

- The firm is highly dependent on Bitcoin’s performance, leaving it vulnerable to market downturns.

Risk Mitigation Strategies

To address these challenges, MicroStrategy could implement the following measures:

1. Diversification

- Gradually diversify treasury holdings into other cryptocurrencies or traditional assets like bonds and equities.

- Maintain higher levels of cash reserves for liquidity.

2. Hedging Strategies

- Use financial derivatives such as options or futures to hedge against Bitcoin price declines.

- Conduct regular risk assessments to balance exposure.

3. Governance and Transparency

- Increase transparency through frequent updates to stakeholders.

- Strengthen board oversight of Bitcoin-related decisions.

Expert Opinions on MicroStrategy’s Strategy

- Many financial experts caution against overreliance on a single asset, emphasizing the need for balanced investment strategies.

- Critics warn of potential liquidity constraints and reputational risks in the event of prolonged Bitcoin price declines.

- Analysts suggest that MicroStrategy should adopt a multi-asset investment framework to ensure long-term sustainability.

MicroStrategy’s transformation from a software company into a Bitcoin-focused company speaks volumes about the value of cryptocurrencies for corporate treasury management. While there are certain risks associated with the operation, it has helped the company generate value worth millions of dollars and become a trendsetter in its very own venture of digital assets. Its strategy might lead other companies to include cryptocurrencies in their financial paradigm as well.

FAQs

MicroStrategy holds 447,470 BTC as of January 2025, making it the largest corporate holder of Bitcoin.

MicroStrategy’s total Bitcoin investment is $27.97 billion as of 2024, reflecting its aggressive acquisition strategy

MicroStrategy funds Bitcoin purchases through convertible notes, equity offerings, and internal cash reserves, diversifying financing sources.

Buying Bitcoin in South Africa involves choosing a reputable exchange, verifying your identity, depositing funds, placing an order and securing your Bitcoin in a personal wallet.

There were no crypto conference appearances or positive social media posts about digital assets during Donald Trump’s 2016 presidential campaign.

17 Jan, 2025 | Admin | No Comments

Crypto execs plan Trump inauguration attendance — at a steep price

Some industry insiders who spent millions to support the US president-elect’s party and fund his inauguration will likely have a good view of the Capitol Building on Jan. 20.

17 Jan, 2025 | Admin | No Comments

Who Owns the Most Government Bitcoin Holdings in 2025? Top 9 Players Revealed

The post Who Owns the Most Government Bitcoin Holdings in 2025? Top 9 Players Revealed appeared first on Coinpedia Fintech News

As of January 2025, governments around the world collectively hold approximately 471,000 Bitcoin (BTC), a staggering 2.5% of the total Bitcoin supply. With the current market price sitting at $34,750 per Bitcoin, this amounts to a mind-blowing $16.37 billion. But how did these governments come to own such vast amounts of Bitcoin?

Governments have acquired Bitcoin in various ways, including criminal asset seizures, strategic purchases, and public donations. Increasingly, they are exploring how to use Bitcoin as both a financial asset and a tool for modernizing economic systems.

Top Government Bitcoin Holdings in 2025

| Rank | Country | Bitcoin Holdings (BTC) | Approximate Value (USD) | Primary Acquisition Method | Notes |

| 1 | United States | 212,000 | $7.37 billion | Criminal seizures (Silk Road, Bitfinex, etc.) | Largest holder; reserves impact the market significantly. |

| 2 | China | 194,000 | $6.74 billion | Seized from the PlusToken Ponzi Scheme | Retains Bitcoin despite crypto trading ban. |

| 3 | United Kingdom | 61,000 | $2.12 billion | Seizures from money laundering and fraud operations | Proactively auctions Bitcoin to fund law enforcement efforts. |

| 4 | Bhutan | 13,029 | $780 Million | Bitcoin Mining | Bitcoin mining through renewable hydropower |

| 5 | El Salvador | 5,800 | $201 million | Actively purchased for national adoption strategy | First country to adopt Bitcoin as legal tender. |

| 6 | Ukraine | 1,200 | $41.7 million | Public donations during the Russia-Ukraine conflict | Bitcoin used for humanitarian and military funding. |

| 7 | Finland | 1,890 | $65.6 million | Seized during narcotics trafficking investigations | Sold some Bitcoin to fund social programs. |

| 8 | Germany | 0 | $0 | Seizures from cybercrime (previously held 46,359 BTC) | Exploring the potential use of Bitcoin for a national digital asset fund. |

| 9 | India | 450 | $15.6 million | Seized in crypto fraud investigations | Exploring potential use of Bitcoin for a national digital asset fund. |

1. United States

The U.S. holds the largest government Bitcoin reserve, mostly obtained through enforcement actions against cybercriminals and dark web markets.

- Bitcoin Holdings: 212,000 BTC

- Approximate Value: $7.37 billion

Accumulation Source:

- Silk Road shutdown that led to the seizure of 69,370 BTC.

- Bitfinex hack case where the government recovered 94,636 BTC from hackers in 2022.

- Jimmy Zhong’s arrest in 2022 where 50,676 BTC were seized.

Current Status: The U.S. typically auctions off part of its holdings, while retaining a significant portion for long-term storage or study. These actions can influence the market, as past sales have affected Bitcoin prices.

2. China

China holds the second-largest Bitcoin reserve, thanks to its crackdown on fraudulent schemes.

- Bitcoin Reserves: 194,000 BTC

- Estimated Worth: $6.74 billion

Accumulation Source: China’s Bitcoin was mainly acquired through the PlusToken Ponzi Scheme, where the scam made off with more than $2 billion in Bitcoins and Ethers.

Current Status: Although it has banned all crypto trading activities, China is keeping its confiscated Bitcoin rather than liquidating it and may be hoarding it to hedge against the continued rise of digital currency as a global currency.

3. United Kingdom

Due to the forceful effort to curb financial crimes related to using digital assets, the United Kingdom has become one of the leading powers.

- Bitcoin Holdings: 61,000 BTC

- Estimated Worth: About $2.12 billion in value

Accumulation Source: Bitcoin seized from illegal money laundering and fraud activities, including cases related to Chinese operators running illegal exchanges.

Current Status: The UK government often auctions seized Bitcoin, using the proceeds to fund law enforcement efforts.

4. Bhutan

Bhutan now accounts for the sum of 13,029 BTC which is worth over $780 million, being considered the world’s fourth biggest state Bitcoin owner. This portfolio in terms of shares makes it equate to about 25% of Bhutan’s GDP, where the big BTC reserve reflects this distinct approach from other countries integrating crypto into national economics.

- Bitcoin Holdings: 13,029 BTC

- Estimated Worth: $780 million.

Accumulation Source: Unlike other governments that are acquiring Bitcoin by seizure or purchase, Bhutan acquired its Bitcoin from its investment in Bitcoin mining with the use of its vast, sustainable hydropower resources.

Current Status: It is a greener strategy as it supports the country’s policy of more extensive renewable energy commitments, which has placed Bhutan at the centre of the fast-emerging area of cryptocurrency and environmental sustainability.

5. El Salvador

El Salvador made history as the first country to adopt Bitcoin as legal tender. Its Bitcoin holdings are actively being purchased as part of a broader national strategy.

- Bitcoin Holdings: 5,800 BTC

- Approx. Value: $201 million

Accumulation Source: Purchased as part of the country’s Bitcoin adoption plan, including the “1 Bitcoin per Day” program launched in late 2022.

Current Status: Bitcoin is used for various purposes in El Salvador, including funding infrastructure development and promoting financial inclusion through the Chivo Wallet.

6. Ukraine

Ukraine’s Bitcoin holdings are primarily sourced from public donations during the ongoing conflict with Russia.

- Bitcoin Reserves: 1,200 BTC

- Estimated Value: $41.7 million

Accumulation Source: In February 2022, the Ukrainian government made its Bitcoin wallet addresses public on social media and sought donations to supplement its military’s funding. Many people and institutions from all over the world donated to this effort.

Current Status: Despite the government taking in more than 1,300 BTC, the active utilization of these funds for humanitarian and military purposes has resulted in 1,200 BTC being set aside.

7. Germany

Germany has been known to confiscate large amounts of Bitcoin from cybercrime operations. As of January 2025, however, the country no longer maintains any Bitcoin reserves.

- Previous Balance: 46,359 BTC

- Liquidation Value: $1.58 billion

Source: Seizures of bitcoins from online piracy sites and dark web activities.

Present Situation: In mid-2024, Germany sold its entire Bitcoin, which caused its market value to depreciate by 15%.

Newly Emerging Players In 2025

1. Finland

Finland gained publicity after it confiscated 1,890 BTC in some cases of narco-trafficking.

- Number of Bitcoins Owned: 1,890 BTC

- Estimated Value: $65.6 million

Policy: Finland used part of the Bitcoin proceeds to finance social programs, thus being pragmatic in its use of the digital asset’s revenue.

2. India

India confiscated 450 BTC in 2024 as part of a crackdown on crypto-related scams.

- Bitcoin Holdings: 450 BTC

- Estimated Value: $15.6 million

Future Potential: The Indian government is considering incorporating confiscated Bitcoin into its economic development policies, and talks are still being held regarding the establishment of a national digital asset fund.

.article-inside-link {

margin-left: 0 !important;

border: 1px solid #0052CC4D;

border-left: 0;

border-right: 0;

padding: 10px 0;

text-align: left;

}

.entry ul.article-inside-link li {

font-size: 14px;

line-height: 21px;

font-weight: 600;

list-style-type: none;

margin-bottom: 0;

display: inline-block;

}

.entry ul.article-inside-link li:last-child {

display: none;

}

Bitcoin’s Growing Role in Geopolitics and Financial Strategy

Governments holding large amounts of Bitcoin have significant influence over the cryptocurrency market. Liquidations, such as Germany’s 2024 sale, can trigger price fluctuations, while announcements of acquisitions or retention may boost market confidence.

Bitcoin is increasingly being seen as a tool for geopolitical strategy. Countries like El Salvador and Ukraine are using it for economic development and wartime funding, while larger economies like the U.S. and China are using their holdings to manage illegal activities and regulate the digital asset market.

Governments’ involvement in Bitcoin reflects the intersection of law enforcement, financial strategy, and technological advancement.

.article_register_shortcode {

padding: 18px 24px;

border-radius: 8px;

display: flex;

align-items: center;

margin: 6px 0 22px;

border: 1px solid #0052CC4D;

background: linear-gradient(90deg, rgba(255, 255, 255, 0.1) 0%, rgba(0, 82, 204, 0.1) 100%);

}

.article_register_shortcode .media-body h5 {

color: #000000;

font-weight: 600;

font-size: 20px;

line-height: 22px;

text-align:left;

}

.article_register_shortcode .media-body h5 span {

color: #0052CC;

}

.article_register_shortcode .media-body p {

font-weight: 400;

font-size: 14px;

line-height: 22px;

color: #171717B2;

margin-top: 4px;

text-align:left;

}

.article_register_shortcode .media-body{

padding-right: 14px;

}

.article_register_shortcode .media-button a {

float: right;

}

.article_register_shortcode .primary-button img{

vertical-align: middle;

width: 20px;

margin: 0;

display: inline-block;

}

@media (min-width: 581px) and (max-width: 991px) {

.article_register_shortcode .media-body p {

margin-bottom: 0;

}

}

@media (max-width: 580px) {

.article_register_shortcode {

display: block;

padding: 20px;

}

.article_register_shortcode img {

max-width: 50px;

}

.article_register_shortcode .media-body h5 {

font-size: 16px;

}

.article_register_shortcode .media-body {

margin-left: 0px;

}

.article_register_shortcode .media-body p {

font-size: 13px;

line-height: 20px;

margin-top: 6px;

margin-bottom: 14px;

}

.article_register_shortcode .media-button a {

float: unset;

}

.article_register_shortcode .secondary-button {

margin-bottom: 0;

}

}

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The United States holds the most Bitcoin among governments, with 212,000 BTC worth $7.37 billion, seized from criminal activities.

MicroStrategy is the largest corporate Bitcoin holder, owning over 450,000 BTC as of January 2025, valued at more than $46.35 billion.

Bitcoin was created by an anonymous entity, Satoshi Nakamoto, in 2009. The true identity behind the name remains unknown.

10 Aug, 2024 | Admin | No Comments

MicroStrategy’s Bitcoin Holdings: Unraveling a High-Stakes Investment Strategy

The post MicroStrategy’s Bitcoin Holdings: Unraveling a High-Stakes Investment Strategy appeared first on Coinpedia Fintech News

Recently, an announcement made by microstrategy

Business Intelligence

executive chairman michael saylor

michael saylor

Michael J. Saylor is an enthusiastic blockchain influencer and a splendid leader. He is an entrepreneur and business executive who co-founded Microstrategy, he is chairman and CEO of the same Microstrategy. He is a vocal advocate of Bitcoin. He is highly skilled in enterprise software and also has a rich knowledge of numerous fields, including analytics, data warehouses, leadership, SaaS, management, cloud computing, startups, professional services, enterprise architecture, mobile devices, and many more.

Location: United States

Education :

He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society.

Experience:

He has been an Executive Chairman & Founder at MicroStrategy from Aug 2022 – Present

He was also Chairman, CEO & Founder of MicroStrategy from Oct 1989 to Aug 2022

Skills: Buisness Intelligence and Data warehousing

Net Worth: Saylor's net worth is about $4.6 billion, according to Forbes. He also held 2.4 million shares of MicroStrategy

Events Attended: Bitcoin 2024 Nashville and BTC prague

msaylor@microstrategy.com

EntrepreneurCrypto and Blockchain ExpertAuthor

about his $1 billion worth of Bitcoin personal investment created headlines. This move has reignited discussions around Bitcoin holdings, particularly those of public companies. MicroStrategy’s obsession with Bitcoin is well-known, having steadily increased its holdings since 2019.

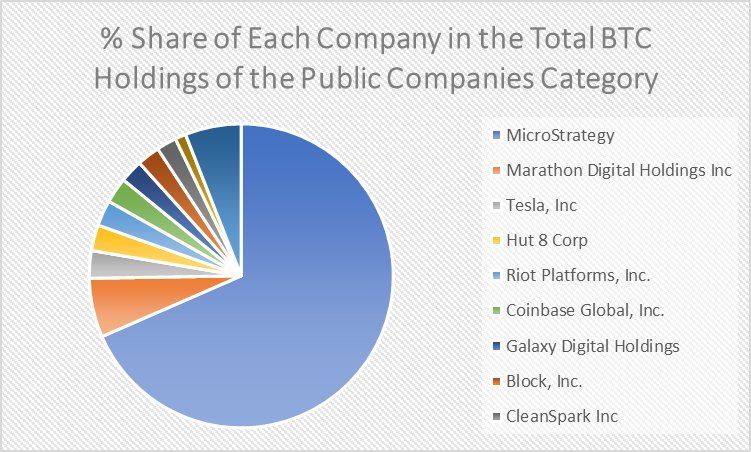

In this article, we will explore all the major data sets compatible to explain the current Bitcoin Holding scenario in the world. This will primarily focus on the top public companies by bitcoin holdings. Naturally, MicroStrategy is going to be the central point of this, as it is a company that holds nearly 68.45% of the total bitcoins held by the public companies category. This is expected to be a memorable journey. Please join!

Bitcoin Holdings by Category: Who Holds What?

Let’s start by breaking down the Bitcoin holdings by different categories. Of the 21 million Bitcoins, the maximum supply cap, approximately 2,609,343 BTC is held by ETFs, countries, public companies, private companies, BTC mining companies, and DeFi platforms.

| Category | Bitcoin Holding | Bitcoin Holding (%) |

| ETFs | 1,057,839BTC | 5.037% |

| Countries | 539,182BTC | 2.568% |

| Public Companies | 330,862BTC | 1.576% |

| Private Companies | 525,474BTC | 2.502% |

| BTC Mining Companies | 53,848BTC | 0.256% |

| DeFis | 155,986BTC | 0.743% |

The category of ETFs holds over 1,057,839BTC, which is nearly 5.037% of the maximum supply cap of BTC. Thus, this category tops the list in terms of Bitcoin Holdings by Category. The category of countries follows with 2.58% (539,182BTC), and the category of private companies sits in the third position in the list above the category of private companies, with 2.502% (525,474BTC. The category of public companies only holds 330,862BTC, which is just 1.576%. DeFis and BTC Mining Companies show as low as 0.743% and 0.256% Bitcoin Holdings, respectively.

By now, we have learned that the category of public companies do hold a considerable amount of BTC, though not as much as the top three categories like ETFs, countries and private companies.

Top Public Companies by Bitcoin Holdings

Here is the interesting part. Nearly 68.45% of the total bitcoins held by the category of public companies is held by MicroStrategy, which is at least 226,500BTC out of 330,862BTC. This is why we need to analyse MicoStrategy separately.

| Company | Bitcoin Holding | Bitcoin Holding (%) |

| MicroStrategy | 226,500BTC | 1.079% |

| Marathon Digital Holdings Inc | 20,818BTC | 0.099% |

| Tesla, Inc | 9,720BTC | 0.046% |

| Hut 8 Corp | 9,109BTC | 0.043% |

| Riot Platforms, Inc. | 9,084BTC | 0.043% |

| Coinbase Global, Inc. | 9,000BTC | 0.043% |

| Galaxy Digital Holdings | 8,100BTC | 0.039% |

| Block, Inc. | 8,027BTC | 0.038% |

| CleanSpark Inc | 7,082BTC | 0.034% |

| Bitcoin Group | 3,830BTC | 0.018% |

When the category of public companies holds around 1.576% of the total BTC supply cap, Microstrategy alone holds at least 1.079%. The second top in the list of the top public companies by bitcoin holdings, Marathon Digital Holdings Inc. only has 20,818BTC (0.099%). Tesla Inc, Hut 8 Corp and Riot Platforms Inc are the other top companies on the list. Tesla Inc and Hust 8 Corp show 9,720BTC and 9,109BTC respectively, and Riot Platforms Inc display 9,084BTC. Coinbase Global Inc and Galaxy Digital Holdings are also on the list with 0.043% and 0.039% Bitcoin Holdings percentages respectively. The BTC Holdings percentages of other major players like Block Inc., CleanSpark Inc. and Bitcoin Group range between 0.038% and 0.018%.

| Company | % of 330,862BTC (held by The Public Companies category) |

| MicroStrategy | 68.45% |

| Marathon Digital Holdings Inc | 6.29% |

| Tesla, Inc | 2.93% |

| Hut 8 Corp | 2.75% |

| Riot Platforms, Inc. | 2.74% |

| Coinbase Global, Inc. | 2.72% |

| Galaxy Digital Holdings | 2.44% |

| Block, Inc. | 2.42% |

| CleanSpark Inc | 2.14% |

| Bitcoin Group | 1.15% |

| Others | 5.97% |

As said earlier, MicroStrategy clearly dominates the category of public companies with 68.45%, that is this public company holds nearly 226,500BTC out of 330,862BTC (which is what the entire category holds). Marathon Digital Holdings Inc, though is the second topmost in the list, only has a 6.29% share in the category of total BTC holdings. Even poorer is the share of Tesla INC and the others. None of the others in the top ten list cross the mark of 3%. Tesla Inc. and Hunt 8 Corp show 2.93% and 2.75% respectively.

The Rise of MicroStrategy’s Bitcoin Holdings

Are you wondering how MicroStrategy has become such a big player in the public companies category in terms of bitcoin holdings? Let’s understand the path through which it has reached such a staggering peak of 226,500. On March 5th, 2021, the Bitcoin holdings of MicroStrategy were just 91,064BTC. In June the same year, it crossed the mark of 100,000BTC. On June 21st, 2021, it was nearly 105,085 BC. By the end of that year, it reached 124,051 BC. In 2022, the growth was slow. On December 24, 2022, it was just around 132,500 BTC.

The year 2023 was different and positive in every way for MicroStrategy’s Bitcoin Holdings. The number of BTC holdings grew from nearly 138,955BTC (on March 23, 2023) to 189,150BTC (on December 27, 2023). In 2024, it crossed another milestone, when it surpassed the mark of 200,000BTC in March. On March 11, 2024, it touched 205,000BTC. From that point, the growth was steady. On June 20, 2024, it recorded 226,331BTC. Now it stands at a peak of 226,500BTC. At present, we see nothing to assume that this range is likely to decrease any time in the near future. There are many who expect the crossing of the 300,000BTC mark by MicoStrategy. Is it possible?

The question can be answered better if we can go through MicroStrategy’s BTC purchase history. Did MicoStrategy make any significant BTC purchases in the recent past?

MicroStrategy Bitcoin Purchase History

Let’s do an analysis of MicroStrategy’s purchase history, and understand what it conveys about the company’s holding strategy.

| Date | BTC Purchased |

| 1st Aug, 2024 | 169 |

| 20th June, 2024 | 11,931 |

| 1st April, 2024 | 164 |

| 19th March, 2024 | 9,245 |

| 11th March, 2024 | 12,000 |

| 26th Feb, 2024 | 3,000 |

| 6th Feb, 2024 | 850 |

| 27th Dec, 2023 | 14,620 |

| 30th Nov, 2023 | 16,130 |

| 1st Nov, 2023 | 155 |

| 24th Sep, 2023 | 5,445 |

| 1st July – 27th July, 2023 | 467 |

| 29th April – 27th June, 2023 | 12,333 |

| 5th April, 2023 | 1,045 |

| 27th March, 2023 | 6,455 |

| 24th Dec, 2022 | 810 |

| 22nd Dec, 2022 | -704 |

| 1st Nov – 21st Dec, 2022 | 2,395 |

| 20th Sep, 2022 | 301 |

| 28th June, 2022 | 480 |

| 15th Feb – 5th April, 2022 | 4,167 |

| 1sth Jan – 31st Jan, 2022 | 660 |

| 30th Dec, 2021 | 1,914 |

| 29th Nov – 8th Dex, 2021 | 1,434 |

| 28th Nov, 2021 | 7,002 |

| 13th Sep, 2021 | 8,957 |

| 21st June, 2021 | 13,005 |

| 18th May, 2021 | 229 |

| 13th May, 2021 | 271 |

| 5th April, 2021 | 253 |

| 12th March, 2021 | 262 |

| 5th March, 2021 | 205 |

| 1sth March, 2021 | 328 |

| 24th Feb, 2021 | 19,452 |

| 2nd Feb, 2021 | 295 |

| 22nd Jan, 2021 | 314 |

| 21st Dec, 2020 | 29,646 |

| 4th Dec, 2020 | 2,574 |

| 14th Sep, 2020 | 16,796 |

| 11th Aug, 2020 | 21,454 |

It was on 11th August 2020 that MicroStrategy made its first Bitcoin purchase. On that day, it made a heavy purchase of 21,454. In that year itself, it made at least two more heavy purchases: the 16,796BTC purchase on 14th Sep and the 29,646BTC purchase on 21st Dec, 2020. What it indicated was that from the beginning stage itself, the public company had a strategy to consistently boost its BTC holdings.

| Year | BTC Purchased |

| 2024 | 37359BTC |

| 2023 | 56650BTC |

| 2022 | 8813BTC |

| 2021 | 53921BTC |

| 2020 | 70470BTC |

This year, 2024, so far, the company has purchased around 37,359 BTC. The highest purchase was made on 11th March. Days before, the BTC price touched an all-time peak of $73,000. Another purchase of similar intensity was made a couple of days after the peak day. On 19th March, nearly 9,245 BTC was purchased. Recently, on 20th June, around 11,931 BTC were purchased.

It was in the year 2020 that the most number of BTC purchases occurred. In that year, over 70,470 BTC purchases took place. The year 2022 was not a good year in terms of MicoStrategy’s BTC Purchases. In that year, the company made no purchase of more than 8,813 BTC. It was the only time a negative purchase happened. On 22nd December 2022, a negative purchase of -704 was reported.

The year of 2021 and 2023 were identical. In both these years, not less than 50,000 BTC were purchased. Interestingly, the nature of purchase in each year was different. In 2021, it was a mix of small and large purchases. The smallest of those purchases was the purchase of 205 BTC, reported on 5th March 2021, and the largest was the purchase of 19,452 BTC, reported on 24th Feb, 2021. In 2023, at least three big purchases were reported: the 14,620 BTC purchase on 27th Dec, the 16,130 BTC purchase on 30th Nov, and the 12,333 BTC purchase between 29th April and 27th June.

Top Private Companies by Bitcoin Holdings

Before going to the conclusion part, we can go through the nature of the BTC holdings of the private companies category and understand how it is different from the public companies category.

| Companies | Bitcoin Holding | Bitcoin Holding (%) |

| Mt. Gox | 200,000BTC | 0.952% |

| Block.one | 140,000BTC | 0.667% |

| Tether Holdings LTD | 75,354BTC | 0.359% |

| Xapo Bank | 38,931BTC | 0.185% |

| BitMEX | 36,794BTC | 0.175% |

| The Tezos Foundation | 17,500BTC | 0.083% |

| Stone Ridge Holdings Group | 10,000BTC | 0.048% |

| Massachusetts Mutual | 3,500BTC | 0.017% |

| Lisk Foundation | 1,898BTC | 0.009% |

| Seetee AS | 1,170BTC | 0.006% |

Here, we can clearly see that unlike the public companies category, there is no domination of the top player. The difference between the number of Bitcoins held by the topmost in the list of the top private companies Bitcoin Holding and the second topmost is just 60,000 BTC. Mt.Gox, the topmost company in the list, holds around 200,000 BTC, and Block.one , the runner-up in the list, has 140,000 BTC. Tether Holdings LTD, Xapo Bank and BitMEX are the other important companies on the list. Tether Holdings LTD has around 75,354 BTC, and Xapo Bank and BitMEX have 38,931 BTC and 36,794 BTC, respectively.

Endnote

MicroStrategy’s aggressive Bitcoin acquisition strategy has positioned it as a key player in the public companies category. Despite a slight slowdown in 2022, the company regained momentum in 2023, with several high-volume purchases. As we move further into 2024, it’s worth watching whether MicroStrategy will surpass its 2020 record for Bitcoin acquisitions and what impact this will have on the broader market.

Also Read: Case Studies of Countries with Significant Crypto Adoption

The post Case Studies of Countries with Significant Crypto Adoption appeared first on Coinpedia Fintech News

Crypto is the new trend in the global economy. It has created several impressive headlines in the recent past, as some of the economic powers have changed its attitude towards the sector. Notably, the global crypto adoption has significantly increased in the recent past. Some countries like El Salvador have implemented certain bold policies, encouraging others to change their stand towards cryptos. Here our attempt is to explore the crypto scenario in those countries which have performed better in the crypto adoption analysis.

Some of the facts this report shares may leave you stunned. And, certain ones may disappoint you. But this mix of contradictions make this report an exceptional one. Don’t miss it.

Top Countries by Crypto Adoption Percentage

The United Arab Emirates, Vietnam and the United States are the top three countries in terms of percentage of population who own crypto.

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| United Arab Emirates | 3M | 30.4% |

| Vietnam | 21M | 21.2% |

| US | 53M | 15.6% |

| Iran | 12M | 13.5% |

| Philippines | 16M | 13.4% |

| Brazil | 26M | 12% |

| Saudi Arabia | 4M | 11.4% |

| Singapore | 665K | 11.1% |

In the United Arab Emirates, nearly three million people own crypto, which is at least 30.4% of its population. Though the United States has 53 million crypto owners, it could not get the top post and remains in the third position, as only 15.6% of its population are crypto owners. Vietnam, which remains in the second spot, has around 21 million crypto owners. In this Asian country, at least 21.2% of its population are crypto owners. Iran and Philippines, with 13.5% and 13.4%, stay in the 4th and 5th positions.

Notably, Brazil has over 26 million crypto owners, but only 12% of its population own cryptocurrencies. Saudi Arabia, with 11.4%, and Singapore, with 11.1%, are notable members.

Top Countries by Number of Crypto Owners

If we only consider the number of crypto owners, things will change slightly. In this list, we have India and China as the top two players. The USA, though has a significant number of crypto owners, is still in the third position. Why?

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| India | 93.5M | 6.55% |

| China | 59.1M | 4.15% |

| USA | 26M | 15.6% |

| Brazil | 26M | 12% |

| Vietnam | 21M | 21.2% |

| Pakistan | 15.9M | 6.6% |

| Philippines | 16M | 13.4% |

| Nigeria | 13.3M | 5.93% |

| Indonesia | 12.2M | 4.4% |

| Russia | 8.7M | 6.1% |

India has over 93.5 million crypto owners, and China has over 59.1 million. The said fact is impressive, but it does not make these countries prominent players. The reason is simple. Only 6.55% of the Indian population owns cryptocurrencies, and in China, the scenario is even worse. The Chinese crypto community enjoying the benefits of crypto ownership is just 4.15% of its total population. Certainly, the USA and Brazil, with 15.6% and 12%, deserve to be considered as top players.

Other prominent countries in the list are Vietnam (21M), Pakistan (15.9M), Philippines (16M), Nigeria (13.3M), Indonesia (12.2M), and Russia (8.7M). Among these, Vietnam and Philippines are significant, as the former’s crypto ownership percentage against its population is as high as 21.2%, and the latter’s is over 13.4%.

Crypto Adoption by Region

Let’s make the analysis a little more interesting. How about entering a little bit deeper and doing a regional-focused analysis? Sounds great, right?

For our convenience, we can divide our geography into three segments: the Europe, Middle East and Africa segment, the Amercians segment and the Asia-Pacific segment.

Crypto Adoption in Europe, Middle East and Africa

Like what the name suggests, the Europe, Middle East and Africa segment covers the countries in the Europe, Middle East and Africa region.

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| Nigeria | 13.3M | 5.93% |

| Russia | 8.7M | 6.1% |

| Ukraine | 3.9M | 10.57% |

| UK | 3.9M | 5.74% |

Generally, people expect that a European country would be a dominant player in the list. To an extent, the expectation is right. But in terms of the number of crypto owners index, none of the European countries match the performance of Nigeria, in which nearly 13.3 million people are crypto owners. Russia, a European superpower, with 8.7M crypto owners, stays in the second position. Ukraine and the UK have 3.9M and 3.9M crypto owners respectively. In the list, Ukraine does have an upperhand, as at least 10.57% of its population are crypto owners. In Nigeria, only 5.93% of its population are crypto-owners, and in Russia and the UK, the values are just 6.1% and 5.74% respectively.

Crypto Adoption in the Americas

There are some surprises in the American segment also. As you know, this segment primarily covers the USA, Canada and Latin America. There is a rumour that the entire crypto industry revolves around this region. Is there any truth to that? Let’s see!

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| USA | 26M | 15.6% |

| Brazil | 26M | 12% |

| Mexico | 8.4M | 6.55% |

| Argentina | 4.45M | 9.73% |

| Canada | 2.7M | 7% |

The USA is the leading player in the region in the crypto adoption landscape, undoubtedly. Otherwise, it would not have such a large number of crypto users. It has over 26 million crypto users – the US crypto community makes at least 15.6% of the country’s total population. Does it sound impressive? But when we consider the adoption rate in other prominent players in the region, it sounds doubtful whether these values are high enough to be considered as a country with the best crypto adoption environment.

Even Brazil has over 26 million crypto users. In that Latin American country, at least 12 percent of its total population own cryptocurrencies. The case is similar in Mexico, where there are over 8.4 million crypto owners – roughly 6.55% of the population. Even Argentina has over 4.45 million crypto owners. Contrary to the general expectation, Canada is very weak in terms of crypto adoption. It only has 2.7 million crypto owners – approximately under seven percent of the country’s total population.

Crypto Adoption in Asia-Pacific

The analysis of the crypto adoption scenario in the Asian-Pacific segment can definitely leave most non-Asians perplexed – particularly those in the developed west. Why? Just go through the below given numbers. Isn’t it enough to ring the bell?

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| India | 93.5M | 6.55% |

| China | 59.1M | 4.15% |

| Vietnam | 20.9M | 21.2% |

| Pakistan | 15.9M | 6.6% |

| Philippines | 15.8M | 13.4% |

| Indonesia | 12.2M | 4.4% |

| Thailand | 6.9M | 9.61% |

| Japan | 5.1M | 4.13% |

| Bangladesh | 4.3M | 2.5% |

No longer can anyone deny the dominant role that the Asia Pacific region plays in the crypto sector. India and China alone have over 1526M crypto owners. In Vietnam, at least 21.2% of its population are crypto owners, and in the Philippines, more than 13.4% of its population are crypto owners. Even in Bangladesh and Pakistan – which are currently struggling due to political unrest and economic uncertainties, there are over 4.3 million and 15.9 million crypto owners respectively. Japan is a crucial player, with 6.9 million crypto owners. Thailand, known for its flourishing tourism sector, even has 6.9 million crypto users.

‘Is the Asia-Pacific adopting cryptos much faster than other two regions’ is a question that can create a lot of headlines in the coming days. With Hong Kong and Singapore, the two prominent financial hubs in the region, eagerly revamping its financial environment to embrace the new possibilities after the advent of the crypto and blockchain technology, the said question is less likely to sound this much indigestible in the future.

Countries with Cryptocurrency as a Legal Tender

Do you know that certain countries have recently accepted cryptocurrencies as legal tender?

El Salvador is the first country to accept cryptos as legal tender. The Central African Republic is the second. In El Salvador, the policy to accept crypto as legal tender was adopted on 9th June 2021. Approximately a year later, on 23rd April, 2022, the Central African Republic joined the league, boldly.

It is said that many counties particularly in the Africa and Latin America region have such a plan.

Crypto Adoption Index Score

Let’s approach the crypto adoption scenario from a different angle. The data set developed by Henley & Partners is an easy way to do so. This data set allows us to approach the crypto adoption scenario using some interesting parameters like public adoption and infrastructure adoption.

At first, we can consider the two prime parameters, public adoption, and infrastructure adoption, and see which country will come at the top in the list when these three are considered together. And later, we can take each parameter individually and see how the scenario changes. Ready?

When we consider these two parameters together, the UK gets the maximum score of 23.2. Australia and Singapore follow with 23 and 22.6 scores.

| Countries | Crypto Adoption Index Score |

| UK | 23.2 |

| Australia | 23 |

| Singapore | 22.8 |

| USA | 22.6 |

| Switzerland | 21.8 |

| UAE | 21.7 |

| Hong Kong | 20.8 |

| Canda | 19.7 |

| Turkey | 18.5 |

| Malta | 17.0 |

USA is in the fourth position with 22.6 score. Switzerland and UAE follow with 21.8 and 21.7 respectively. Hong Kong, Canada, Turkey and Malta are the other prominent players. Hong Kong scores 20.8. Canada, Turkey and Malta show 19.7, 18.5 and 17, respectively.

Crypto Adoption Score By Public Adoption

Time to consider each parameter individually. First, we can consider the parameter of public adoption.

| Countries | Score |

| Singapore | 7.1 |

| UAE | 7.1 |

| USA | 6.3 |

| UK | 5.5 |

| Australia | 5.1 |

| Canada | 5.1 |

| Mauritius | 4.7 |

| Hong Kong | 4.6 |

| Switzerland | 3.9 |

| Malta | 3.6 |

Singapore and UAE dominate with the same score of 7.1. USA follows with a score of 6.3. The UK and Australia report 5.5 and 5.1 respectively, and Canada and Mauritius record 5.1 and 4.7 respectively. Hong Kong and Switzerland are other two important players. The former has a score of 4.6 and the latter has a score of 3.9. Malta, with 3.6 score, also enjoys a place in the list.

Crypto Adoption Score By Infrastructure Adoption

Let’s consider the parameter of infrastructure adoption. As expected, the US is the country which enjoys the top position in the list.

| Countries | Score |

| USA | 9.6 |

| Canada | 9.3 |

| Switzerland | 9.2 |

| Australia | 9.1 |

| UK | 7.7 |

| Hong Kong | 7.5 |

| Thailand | 7.5 |

| Monaco | 7.5 |

| Greece | 7.5 |

| New Zealand | 7.4 |

The US shows a score of 9.6. Canada, Switzerland, and Australia closely follow with 9.3, 9.2 and 9.1, respectively. The UK, Hong Kong, Thailand, Monaco, Greece and New Zealand are the other countries who sit in this list. The UK has a score of 7.7, and New Zealand 7.4. The four remaining ones have the same score of 7.5.

Countries with the Best Regulatory and Tax Environment for Cryptos

One of the prime factors that influence a country’s crypto adoption is its regulatory and tax environment. In the Henly & Partners’ data set, there are provisions to generate a score considering the parameters of crypto regulation and tax environment.

The below is the list of these countries which score the highest when the said parameters are considered.

Singapore naturally remains in the top most position with 18.5, reflecting how dedicated is the Asian region in developing their environment to embrace the emerging digital finance possibilities.

| Countries | Score |

| Singapore | 18.5 |

| Switzerland | 16.5 |

| Antigua and Barbuda | 15.8 |

| Hong Kong | 15.7 |

| UAE | 15.6 |

| Mauritius | 15.4 |

| Netherlands | 14.7 |

| Malaysia | 14.5 |

| Malta | 14.4 |

| Monaco | 14.4 |

Switzerland and Antigua and Barbuda are the countries that follow Singapore. Switzerland shows 16.5, and Antigua and Barbuda displays 15.8. Another Asian financial centre, Hong Kong, with 15.7, enjoys the fourth position in the list. UAE and Mauritius score 15.6 and 15.4 respectively. Netherlands, Malaysia, Malta and Monaco are the other prominent players. Their scores range from 14.7 to 14.4.

Top Countries with the Best Economic Factors for Crypto Adoption

Is creating a crypto friendly regulatory and tax environment enough to improve the crypto adoption scenario of a country? In most cases, it is inadequate. The fact is that in the absence of a right economic environment, any effect to revamp a country’s regulatory scenario would be counter productive.

As per the Henley & Partners data set, here are the top countries with the best economic factors suitable for the flourishing of the crypto adoption environment.

The list is dominated by two powerful financial hubs from the Asia-Pacific region. You may have already guessed it. Yes, Hong Kong, with 9.1, and Singapore, with 8.9, are the two countries which sit in the top most positions in the list.

| Countries | Score |

| Hong Kong | 9.1 |

| Singapore | 8.9 |

| Switzerland | 8.6 |

| UAE | 8.4 |

| New Zealand | 8.4 |

| Luxembourg | 8.3 |

| USA | 8.2 |

| Netherlands | 8.1 |

| Thailand | 8.1 |

| Canada | 8.1 |

Switzerland, with 8.6, and UAE, with 8.4, remain in the third and fourth positions, respectively. New Zealand, Luxembourg, the USA, the Netherlands, Thailand and Canada are the other prominent countries in the list. New Zealand and Luxembourg and the USA have 8.4, 8.3 and 8.2 scores respectively. All the three remaining ones. the Netherlands, Thailand and Canada display the same score of 8.1.

Endnote

In conclusion, what is clear from the data collected is that the Asia-Pacific region currently leads the world in crypto adoption, with countries like Singapore and Hong Kong poised to become global hubs for the crypto economy. As these nations continue to innovate and set new standards, they are likely to shape the future of digital finance and serve as a model for others to follow. It does not mean that the other regions perform poorly in crypto adoption. It is important to watch the developments in certain important crypto economies like the USA, India, China, Thailand, the Philippines, El Salvador, the Central Asian Republic, Brazil and even Bangladesh and Pakistan. One thing is clear that this crypto revolution is set to continue, and is likely to transform the lives of millions in near future.

The post Trump’s $35 Trillion Debt Plan: Analysing The Impact on Cryptos appeared first on Coinpedia Fintech News

Recently, Donald Trump proposed an audacious idea: using Bitcoin to address the United States’ staggering national debt. This suggestion has ignited intense debate, particularly within the cryptocurrency community. Can Bitcoin truly be a remedy for the national debt? What would this mean for the crypto industry, and how might Bitcoin’s price be affected? Let’s explore these questions in detail!

Understanding the US Debt Crisis

As per the official data published by the US government, the national debt of the United States, or the amount of outstanding borrowing the government accumulated over the nation’s history, is nearly $35.05 trillion, as of 6th August, 2024.

Here’s a snapshot of the national debt’s growth over the past century:

| Year | U.S. National Debt |

| 1923 | $403 B |

| 1943 | $2.40 T |

| 1963 | $3.07 T |

| 1983 | $4.20 T |

| 2003 | $11.24 T |

| 2013 | $21.93 T |

| 2023 | $33. 17T |

In 1923, almost 100 years ago, the US national debt was just $403 B. Between 1923 and 1943, the growth of the depth was comparatively slower. In 1943, the debt was a little more than $2.40 T. In 1963 and 1983, the values were $3.07 T and $4.20T. Between 1943 and 1983, the depth growth was majorly stagnant. Post 1983, it was a period of sharp rise. In 2003, the debt reached as high as $11.24 T. In 2013, it nearly doubled to $21.93 T. In 2023, it reached a shocking high of $33.17 T. Now, it stands at $35.05 trillion.

What reveals a country’s ability to pay down the country’s debt to its GDP ratio. Shocking is the US’ debt to its GDP ratio. It now stands far above one hundred per cent. In fact, it surpassed the mark of 100% as early as 2013 itself. In 2023, it was 123%.

Here is the US’ debt-to-GDP ratio:

| Year | US Debt to GDP |

| 1948 | 96% |

| 1958 | 58% |

| 1974 | 32% |

| 1996 | 66% |

| 2001 | 55% |

| 2020 | 127% |

| 2023 | 123% |

In 1948, the ratio was around 96%. But it fell to 58% in 1958, and further to 32% in 1974. In 1996, it reached 66%. Later, in 2001, it cooled down to 55%. Later, it saw a sharp rise. In 2020, it touched a peak of 127%. In 2023, it slightly came down to 123%.

The data indicates that the biggest crisis the United States and its people now face is its growing debt and the weakening debt-to-GDP ratio.

Trump’s Bitcoin Debt Solution Plan Explained

Trump’s Bitcoin debt solution revolves around using Bitcoin and cryptos to manage the US debt. In a recent interview, he proposed that Bitcoin could be used strategically to address the growing financial burden. Making Bitcoin a strategic reserve was a major part of his plan.

BTC Holdings Owned by Governments

The United States government at present owns nearly 207,189 bitcoins, which is 0.98% of the total holdings. The current value of its entire holdings is $10,458,345,453.

As per a data set published in bitcointreasuries.com, here are the top governments by BTC Holdings.

| Country | No. of BTC | Value | Percentage |

| USA | 207,189 | $10,458,345,453 | 0.987% |

| China | 194,000 | $9,792,600,080 | 0.924% |

| UK | 61,000 | $3,079,116,520 | 0.29% |

| Ukraine | 46,351 | $2,339,674,259 | 0.221% |

| Germany | 22,846 | $1,153,204,853 | 0.109% |

| El Salvador | 5,748.76 | $290,181,998 | 0.027% |

| Finland | 1,981 | $99,995,571 | 0.009% |

| Georgia | 66 | $3,331,503 | 0.0% |

China is the country that holds the highest number of BTCs after the USA. It owns nearly 194,000 BTC (0.92%), valued at $9,792,600,080. The UK, Ukraine and Germany are also top players with 61,000, 46,351, and 22,846 BTCs respectively.

The Feasibility of Trump’s Plan

The current price of Bitcoin is $55,645.47 and its market cap is $1,095,191,354,069. For Trump’s plan to work, each Bitcoin would need to be worth $180 million. Critics argue that expecting BTC to reach such an astronomical value is unrealistic.

Peter Schiff, a financial expert, opines that Trump’s proposal is unrealistic. He claims that the idea of Bictoin reaching such high values without causing inflation is logically inconsistent.

Bitcoin Annual Price Change Analysis

This analysis shows how Bitcoin’s value fluctuates each year. It is capable of providing insights into growth trends.

In 2023, the annual price change of Bitcoin was +155.4%. In 2013, 2011 and 2017, Bitcoin witnessed massive changes of +4,435%, +1,435% and +1.369%. Since 2011, only three times that Bitcoin witnessed a negative yearly price change. In 2018, 2022 and 2014, it marked negative changes of -73.3%, -64.3% and -57.6%. This year the value stands at around +32.3%.

Potential Impact on the Crypto Industry

If Trump’s plan were to gain traction, it could have significant impacts on the crypto industry. Increased government involvement in Bitcoin could lead to more regulations. But, it could also boost confidence in Bitcoin.

BTC Historical Price Change Analysis

In the last 24 hours, Bitcoin has seen a rise of 5.0% ($2,134 change). Year to Date, the change is +30.3%, which is $12,799. In the last six months, a change of +27.6%, which is around $11,907, has been recorded. In the Q1 of 2024, the BTC provided a return of +68.7%. But, the last quarter, that is the Q2 of 2024, was a period of great volatility. The period ended with an unimpressive return of -12%. In April and June, BTC saw negative returns of -14.7% and -7.02%. In May, it witnessed a positive return of +11.1%. In the second quarter’s closing price was just $62,743, far less than the first quarter’s price of $71,262. In the last three months, a negative return of -11.8% was recorded, and in the last 30 days, a return of -4.27% was reported.

At present, the price of BTC stands at around $55,124. In the beginning of the month, the price was around $65,246. On 2nd, 4th and 5th August, the Bitcoin market witnessed long red candlesticks. Between 1st and 6th August 2024, a steep drop in price occurred in the market. The trend we are witnessing now in the market is in stark contrast to the one we saw last month, when the price experienced an upward momentum between 8th July and 28th July. Actually, it was in late July, especially on 29th July, that this new selling pressure stepped in. Between 29 July and 5th Aug, we see only one green candle.

Endnote

Trump’s proposal to use Bitcoin to tackle the $35 trillion US debt is undeniably bold. While it highlights the increasing interest in cryptocurrencies as potential strategic assets, it also raises questions about feasibility and market impact.

By examining inflation data, government Bitcoin holdings, historical price trends, and recent changes, we gain a clearer understanding of the potential and challenges of this idea. Whether Trump’s plan benefits the crypto industry remains uncertain, but it undoubtedly fuels crucial discussions about the future of cryptocurrency and its role in the global economy.

Also Check Out: Bitcoin and Ethereum Q2 Price Movement Analysis Report

As the debate heats up, one thing is clear: Trump’s Bitcoin proposal could either revolutionize how we think about national debt or simply add more fuel to the crypto fire. Stay tuned to see where this bold idea will lead!

The post Bitcoin and Ethereum Q2 Price Movement Analysis Report appeared first on Coinpedia Fintech News

The Quarter Two of the Year 2024 was an eventful period for the crypto sector. During the period, the crypto market, especially the Bitcoin and Ethereum markets, witnessed several important events, capable of influencing market sentiment. Time to do an analysis to understand the Q2 price movements of the top two cryptos. Ready?

Bitcoin and Ethereum: Quarterly Performance Recap

In Q2, Bitcoin recorded a quarterly return of -12%, while Ethereum saw a return of -5.08%. These figures are a stark contrast to Q1, where Bitcoin enjoyed a +68.7% return and Ethereum a +59.8% return. April 2024 saw Bitcoin’s lowest monthly return at -14.7%, and June at -7.02%. However, May brought some relief with Bitcoin posting an impressive +11.1% return, which helped cushion the overall quarterly decline. Similarly, Ethereum had a stellar performance in May with a +24.7% return, though April and June saw drops of -17.2% and -8.64% respectively.

By the end of Q2, Bitcoin’s closing price was $62,743, a significant drop from Q1’s $71,262. Ethereum also saw a decrease, closing at $3,436 compared to $3,645 at the end of Q1.

This data indicates that Q2 was less favorable for both Bitcoin and Ethereum, necessitating a deeper analysis of the events influencing these price movements. This can provide valuable insights into what to expect in Q3. Let’s analyze these events month-by-month, starting with April.

April: Price Sentiment Analysis

Bitcoin’s April Journey

On April 1st, Bitcoin’s price was around $71,263, significantly lower than its all-time high of $73,037 on March 13, 2024. By the end of April, the price had slipped to $60,617, marking a period of decline. The month began with a red candlestick, and despite an early attempt to recover, the price dropped sharply after April 8th until April 17th. Mid-April saw another recovery attempt, but post-April 22nd, Bitcoin’s price fell again with no signs of recovery.

One major event in April was Bitcoin Halving on April 20th, which initially spurred positive sentiment. Two days before the event, Bitcoin’s price rose to $66,810, a $5,564 increase in just five days. However, this positive momentum was short-lived.

Ethereum’s April Performance

Ethereum’s story in April mirrored Bitcoin’s. Starting the month at $3,645.56, it fell to $3,015.41 by month’s end. Early April saw a brief climb to a monthly peak of $3,693.22, but this momentum did not last. Between April 9th and 17th, Ethereum faced strong selling pressure, with a significant decline of 13.85% between April 11th and 13th. The price hit a monthly low of $2,985.40 on April 17th before recovering slightly towards the end of the month.

Two key events influenced Ethereum’s price sentiment in April: the Middle East crisis and Bitcoin Halving. The Middle East crisis contributed to the price fall between April 9th and 17th, while the Bitcoin Halving helped generate positive momentum after April 18th.

Bitcoin and Ethereum: May Price Sentiment Analysis

For Bitcoin, the month of May 2024 was largely positive. The month began with a price of just $58,289. On the last day of that month, the price closed at $67,482. On the second day of the month itself, a strong buying pressure stepped in. It took the price to a high of $64,019, within a couple of days. Between 6th May and 14th May, the sellers of the market attempted to contain the upward momentum.

On the 15th of May, with a strong green candlestick, the buyers of the market defeated the sellers. They helped the market to reach as high as $71,390, on 20th May. Later, the price of BTC slightly slipped, indicating a renewed attempt by the sellers to contain the momentum.

The major events reported in the month of April were the movement of nearly 4,550 Bitcoin from exchange to more secure ‘Cold Storage’ locations, the indication of reduced inflationary pressure in the April US non-farm payrolls report, the postponement of the SEC’s decision on ETH Spot ETFs on 6th May, the request of the SEC to provide updated 19b-4 filings, the approval of nearly eight Ethereum Spot ETF applications by the SEC on 23rd May, and the passing of the Financial Innovation and Technology for the 21st Century Act (FIT21) in the House of Representatives on 22nd May.

Almost all these events not only influenced the market sentiment in the Bitcoin market but also affected the sentiment in the Ethereum market – in fact, the sentiment in the entire crypto market.

Ethereum’s May Momentum

The postponement of the SEC’s decision on ETH Spot ETFs on 6th May might have sent negative impressions about the prospects of the market. Naturally, the selling pressure stepped in post the said date. Post 11th May, several positive developments occurred like the movement of around 4,550 Bitcoins from exchanges to cold storage locations, and the change of stand of the SEC towards the Spot ETF applications (on the wake of increasing prominence of the crypto regulation issues in the US election discussion forums and platforms). The most prominent ones among those were the approval of the Ethereum Spot ETF applications and the passing of the FIT21. On 20th May, a large green candlestick occurred. Though a small selling pressure emerged post that day, it could not take the price below the low of the candle of 20th May.

In the Ethereum market, the situation was similar in May also. The market began the month with a price of $2,969.36. On the last day of the month, it crossed $3,760.14. Between 6th May and 14th May, negative sentiment was dominant, most probably due to the SEC’s unwelcoming attitude towards the Spot ETF application on 6th May. The sentiment slowly shifted from negative to positive, as the SEC changed its attitude towards the ETF applications. On May 20, just two days before the SEC’s application approval, the market created a large green candle; in a single day, the price climbed from $3,073.50 to $3,659.53. After that, the price never dropped below the high of that day till the end of that month.

June: Price Sentiment Analysis

Bitcoin’s June Decline

Bitcoin opened the month of June with a green candle; the price was nearly $67,728. The positive momentum lasted till the 5th of June when the price touched the month’s peak of $71,109. What followed was a period of sharp decline. The downtrend lasted till the 24th of June when the price reached as low as $60,256. Towards the end of the month, though the price showed a slight recovery, it could not rise beyond $62,686 – the closing price of BTC in June.

Several events, capable of influencing the crypto market, particularly the Bitcoin and Ethereum markets, occurred in the month of June. The massive victory of around 33 of the 35 FairShake-backed (or crypto-backed) candidates in the US Congressional primaries, the release of the positive statements of Republican US Presidential candidate Donald Trump

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

about the crypto landscape, the introduction of a bill to allow US taxpayers to pay federal taxes in BTC by Congressman Matt Gaetz, the liquidation of millions of dollars in Bitcoin by the German government, and the announcement of Mt. Gox, a failed crypto exchange, about its plan to repay its creditors.

Notably, the majority of the events that were helpful to positively influence the market took place towards the end of the month. It explained from where the price received the required buying pressure to contain the strong selling pressure the market had been experiencing since the 6th of the month.

The trend was slightly different in the Ethereum market. In the market, the opening price of the month was $3,813.05. However after the 5th of June, the price fell, but the fall was not as sharp as what was witnessed in Bitcoin. Ethereum was majorly in a sideways market in the month. The closing price of the month was around $3,432.25. Interestingly, the market opened and closed with a green candlestick – almost identical in length as well. The Ethereum market might have benefited from the positive sentiment it acquired post the approval of the Spot ETF applications by the United States SEC, apart from the above-mentioned general aspects which contributed positive sentiment to the overall crypto market.

Endnote

In conclusion, Quarter Two of the Year 2024 was a period of great volatility for the crypto market – especially the Bitcoin and Ethereum markets. The period witnessed several powerful events capable of influencing market sentiment, like the Bitcoin Halving and the approval of the Ethereum Spot ETF applications by the US SEC.

One of the notable things observed this quarter was that the US political landscape started doing more discussions about the future of the crypto market, especially after Donald Trump openly admitted his positive attitude towards the crypto industry. This Republican candidate became the first to accept campaign donations in crypto.

Also Check Out: 2024 Crypto Market Insights: ETF Approvals, Regulatory Frameworks, and Market Dynamics

3 Jul, 2024 | Admin | No Comments

2024 Crypto Market Insights: ETF Approvals, Regulatory Frameworks, and Market Dynamics

The post 2024 Crypto Market Insights: ETF Approvals, Regulatory Frameworks, and Market Dynamics appeared first on Coinpedia Fintech News

The first half of 2024 was a challenging time for the crypto market. There was an increase in both regulatory scrutiny and institutional adoption. Despite these challenges, the market has shown an upward momentum, with the total crypto market capitalization increasing over the past six months.

The crypto industry is gaining institutional adoption, so it’s important to review significant market developments regularly. The crypto markets peaked in late 2021, and we are now nearing the three-year mark since that peak. This is a good time to step back and examine the state of the markets and key developments in various areas of the Web3 space.

Today, we will look at Coinpedia’s half-year report for the first half of 2024. We will explore the landscape of major crypto and Web3 sectors, including layer-1 and layer-2 solutions, stablecoins, decentralized finance, non-fungible tokens, and institutional adoption.

Top Crypto News In H1 2024

SEC-approved spot Bitcoin ETF trading

The US Securities and Exchange Commission (SEC) approved US-listed Bitcoin exchange-traded funds (ETFs) in January. The SEC I approved 11 applications from BlackRock, Ark Investments, Fidelity, Invesco, VanEck, and others to launch ETFs tracking Bitcoin, despite warnings from officials and investor advocates about associated risks.

The Bitcoin ETFs are listed on the New York Stock Exchange (NYSE), Nasdaq, and Chicago Board Options Exchange (CBOE).

US House passed crypto bill despite warnings from SEC

In May, the U.S. House of Representatives passed a bill to establish a new legal framework for crypto currencies, despite a warning from the U.S. securities regulator about potential financial risks.

US passed the “Financial Innovation and Technology for the 21st Century Act,” establishing a regulatory framework for cryptocurrencies and outlining the responsibilities of the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Sam Bankman-Fried sentenced to 25 years in prison

Crypto entrepreneur Sam Bankman-Fried was sentenced to 25 years in prison for defrauding hundreds of thousands of customers after the collapse of FTX, a popular digital currency exchange.

Despite acknowledging Bankman-Fried’s intelligence, U.S. District Judge Lewis A. Kaplan harshly criticized him and his crimes before issuing a sentence that was half of what prosecutors wanted and much less than the 105 years recommended by probation officers.

SEC accelerates spot Ether ETF approval process

The U.S. Securities and Exchange Commission could approve ether spot price exchange-traded funds (ETFs) by July 4, as talks between asset managers and regulators reach the final stages, sources told Reuters. It previously gave an initial greenlight for spot Ether ETF in May.

Eight asset managers, including BlackRock, VanEck, Franklin Templeton, and Grayscale Investments, seek SEC approval for the funds.

Terraform Labs and Do Kwon agreed to pay the SEC a combined $4.5 billion in a civil fraud case

Terraform Labs and its former CEO Do Kwon have agreed to a settlement with the SEC to pay $4.5 billion in disgorgement and civil penalties. The settlement also permanently bans Kwon and Terraform Labs from trading crypto asset securities, including all tokens in the Terra ecosystem.

Binance faced trouble in Nigeria

Binance, the world’s largest cryptocurrency exchange, is facing legal battles in Nigeria as the country cracks down on the industry for allegedly facilitating criminal activity and undermining the naira.

In February, two Binance senior executives, Tigran Gambaryan and Nadeem Anjarwalla, were arrested in Nigeria for allegedly ignoring criminal activities like tax evasion and money laundering.

According to the government, Binance is responsible for weakening the Naira currency. In the first half of 2024, the Nigerian currency depreciated by nearly 40%, marking it as the worst-performing currency during that time.

Overview of the Crypto Market Cap

In the initial six months of 2024, 89% of sectors witnessed a reduction in market capitalization, with more than 30 industries experiencing losses ranging from 20% to 40% in value. During the second quarter, only three sectors recorded positive growth, underscoring the tough market conditions.